Hottest and driest conditions since Black Summer forecast

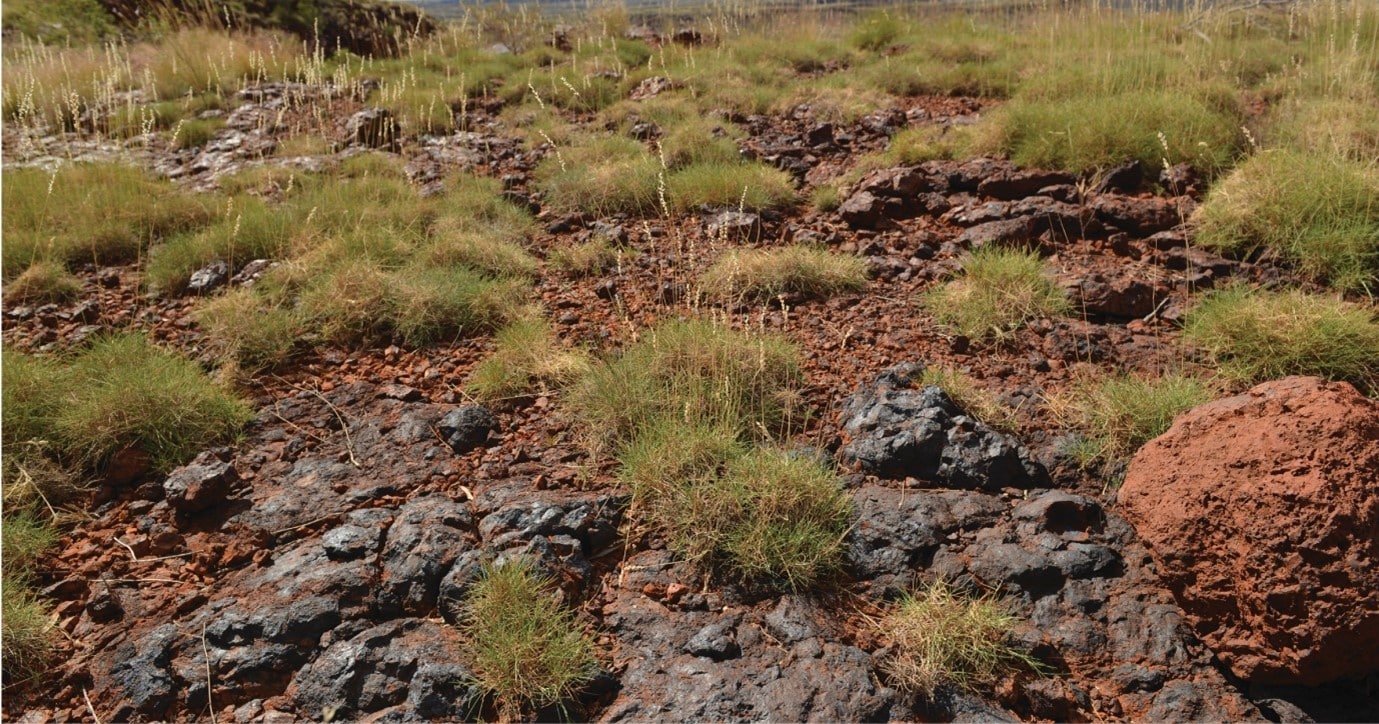

The 2019-20 Black Summer is seared into our nation’s collective memory. The devastating bushfires swept from coast to coast decimating an estimated 24.3 million hectares, destroying more than 3,000 buildings (including 2,779 homes), and killing 33 people directly (another 450 more lost their lives from the effects of smoke inhalation), as well as wiping out billions of wildlife. Treasury estimates that the total economic impact of the Black Summer bushfires was a $4.6 billion reduction in GDP, while the Insurance Council of Australia (ICA) says the total insured damage from this catastrophic event totalled $2.32 billion, with close to 39,000 claims lodged.

The advent of three consecutive La Niña years since those historic fires saw the bushfire risk lessen but, with El Niño and a positive Indian Ocean Dipole declared, the risk has once again increased.

The Australasian Fire Authorities Council’s Seasonal Bushfire Outlook forecasts an increased risk of bushfire for large areas of the Northern Territory, Queensland and New South Wales, as well as regions in Victoria and South Australia, throughout spring and into summer. Drier and warmer conditions are also expected to increase the bushfire risk in Western Australia, Tasmania and the Australian Capital Territory come summer.

The heightened risk of bushfires is being fuelled by above-average rainfall experienced in recent years on the east coast which has resulted in high vegetation growth. Coupled with higher chances of above-average temperatures and below-average rainfall, it is set to be the first dry spring/summer since the Black Summer. So far this season, major bushfires have broken out in New South Wales, Victoria and Queensland, with PerilAUS noting that the majority of damaging bushfire events occur in the summer (e.g. 72% of events in NSW occur over summer and 86.9% in Victoria).

Fire services respond to between 45,000 and 60,000 bushfires in Australia each year, and the Australian National University estimates that bushfires cost the economy an average of $1.5 billion every year.

Yet despite the known risk, many Australians are unprepared for the bushfire season. According to a survey by QBE, 84.1% of Australians are concerned about the El Niño bushfire threat. However, 51.1% of respondents didn’t know their property’s bushfire attack level (BAL) and just 6.4% had a bushfire evacuation plan. Research from NRMA Insurance also found 49% were concerned about being impacted by bushfires this spring and summer, but only 23% had taken steps to protect and prepare their properties. A study by Suncorp found many Australians were unaware of bushfire risks and facts, such as embers can travel up to 40km during a very intense bushfire (26% didn’t know) or that lightning is one of the most common causes of bushfire (31% didn’t know). Concerningly, 42% incorrectly assume it is safe to remain at the property unless advised otherwise by emergency services.

In light of the increased risk, the ICA and numerous insurance companies are urging business owners and operators to be prepared for the extreme bushfire season.

Businesses in bushfire-prone areas need to act to prepare the property for the risk and to protect assets.

4-step action plan

Step 1 – Understand the risks:

- Know the bushfire risks in the area.

- Know and understand the updated Australian Fire Danger Rating System.

- Check the fire danger rating for the area daily to help understand local weather conditions and the threat of bushfire.

- Know the bush fire attack level (BAL) for the business premises – premises with higher BAL ratings and those in bushfire-prone areas have greater mitigation requirements.

- Ensure the property meets any BAL/Building Code requirements (e.g. has metal flyscreens installed).

- Speak with the local authority and emergency services about the community’s emergency plans, warning signals, evacuation routes and locations of emergency shelters. Ensure these are detailed in emergency plans.

- Download the Fires Near Me Australia app or the equivalent state/territory app on all company-owned devices.

- Know the local ABC radio station frequency.

- Bookmark the state/territory emergency services website.

Step 2 – Assess and update plans:

- Ensure emergency contacts are up-to-date including local fire service, council disaster dashboards, bushfire maps. Also ensure all staff contacts are current.

- Review emergency processes.

- Review the bushfire/emergency action plan.

- Share the bushfire plan with everyone involved with the business.

- Train staff to ensure they understand their roles and responsibilities during an emergency.

- Ensure the emergency management, evacuation, communication, business continuity and recovery plans are up-to-date and reflect current conditions.

- Be sure to account for any changes at the property and within the local community and surrounds (such as evacuation centres, warnings etc.).

- Ensure all employees, including those not located on-site (e.g. drivers or sales reps), are aware of the emergency plans including fire-fighting protocols and evacuation procedures (assembly points, routes out, contact numbers etc.).

- Conduct evacuation drills.

- Back-up critical data and safeguard important documents (store copies on a USB away from the premises and/or in the cloud).

- Plan ahead – do not schedule hot works and the like during hot, dry and windy weather conditions.

Step 3 – Prepare the property:

- Inspect the property and eliminate any potential hazards:

- maintain fuel-free fire breaks around premises and property boundaries, beside laneways, roads and tracks, around sheds, chemical storage and yards, around water supply infrastructure, fuel storage and powerlines

- reduce fuel load in and around sensitive areas including buildings and gardens, sheds and mobile machinery parking pads, and yards and confinement areas

- clean out the gutters and roof gullies of leaves and other debris

- mow the grass regularly

- prune trees that overhang the property

- remove excess ground fuel

- eliminate any combustible materials or flammable liquids from around and under the property

- seal up (or add mesh screens to) any areas where embers could enter the property such as underfloor, roof eaves, roof-mounted external air-conditioners or windows without metal flyscreens

- determine the risk of ignition from nearby combustible structures such as outbuildings, neighbouring buildings, fencing or decking.

- Ensure the property is compliant with current safety recommendations and requirements.

- Check the resilience of building materials to make sure they are fire-resistant and non-combustible.

- Regularly check/test safety devices on the property, such as smoke alarms, sprinkler systems and fire extinguishers.

- Ensure there is adequate water supply on the property.

- Equip employees with essential PPE.

- Know how to disconnect the property’s gas, water and electricity.

- Ensure there is clear access into and out of the property.

Step 4 – Check insurance cover:

- Identify the risks the business faces – physical (from natural perils) and financial (from business interruption).

- Assess the vulnerability of business property and assets including off-site buildings, vehicles, products/stock and supplies, and equipment. Consider the materials, condition and other factors such as storage of flammable goods and proximity to other property or perils such as bushland.

- Reassess cover every year. Consider whether any changes are needed to existing policies or if other insurances are required (e.g. vehicles or machinery, business interruption, income protection, or liability cover).

- Check the property policies to ensure the declared values match current replacement, repair and rebuild costs for buildings, vehicles and equipment, stock and supplies.

- Ensure outdoor assets such as sheds, fencing, plant or machinery are accounted for in the policies.

- Ensure the indemnity periods in business interruption cover allow for supply chain hold-ups in material supply and labour shortages, and take into consideration the availability (or otherwise, due to supply chain delays) of replacement vehicles and equipment.

- Check that the right liability covers are in place. Discuss the risks posed and covers available for public liability, employment practices liability and professional lines such as D&O and professional indemnity.

Chat with your EBM Account Manager

A major aspect of preparing for a bushfire is ensuring that the property and its contents are properly insured. Despite the risk facing much of the country each year, the ICA estimates that more than eight in 10 properties are likely to be under- or un-insured against bushfires.

To reduce the risk, business owners should check that they are adequately covered before the first hint of flames appear on the horizon.

Once a bushfire is imminent or already occurring, it is generally too late for property owners to take out cover or update existing policies.

Insurance companies often impose embargoes when a disaster such as a bushfire, flood or cyclone is likely to impact an area. While some insurers may not impose an embargo, the policy may instead have a restriction on paying any claims within a certain period, for example within 72 hours of the policy being purchased.

So before disaster strikes, it is worth checking that your property and its contents are properly covered. Your broker will work with you to ensure that the insurance policies you have in place:

- Actually cover losses from bushfire. You need to understand what coverage is provided, as well as any exclusions or limits that may form part of the policy. For example, many policies do not provide cover for loss or damage where no flame damage has occurred, such as damage caused by scorching, melting, heat, smoke, ash or soot.

- Adequately protect your most valuable assets by ensuring that the sums insured match the value of the assets.

- Have the sum insured based on the current building replacement costs. Since the Black Summer fires, a number of changes to regulations around planning, developing, building and rebuilding properties in fire-prone areas changed, making the cost to rebuild to the new standards and BAL rating system much higher. Building codes changing over time to incorporate new safety standards related to fire resilience impacts the cost of replacement, and policyholders can find themselves underinsured if the associated costs (depending on the risk level of the property) are not factored into sums insured.

Your broker will also help you to understand what your obligations are in respect to the loss mitigation clauses in the policy.