Your insurance broker is a risk transfer expert and a trusted partner for your business.

EBM Account Managers work for you, and with you, to help protect what’s important to you.

As the modern insurance industry has evolved from the 1600s when Lloyd’s of London was established, so too has the insurance broking profession. But one thing has remained constant – brokers are there to support their client in finding the most appropriate insurance solution (terms, coverage, price and claims support).

EBM Insurance & Risk has been providing expert risk management and insurance advice to clients of all sizes across numerous industries for 48 years.

Our Account Managers are highly qualified and committed to each of their clients and to ongoing professional development to ensure they continue to provide clients with appropriate risk transfer advice.

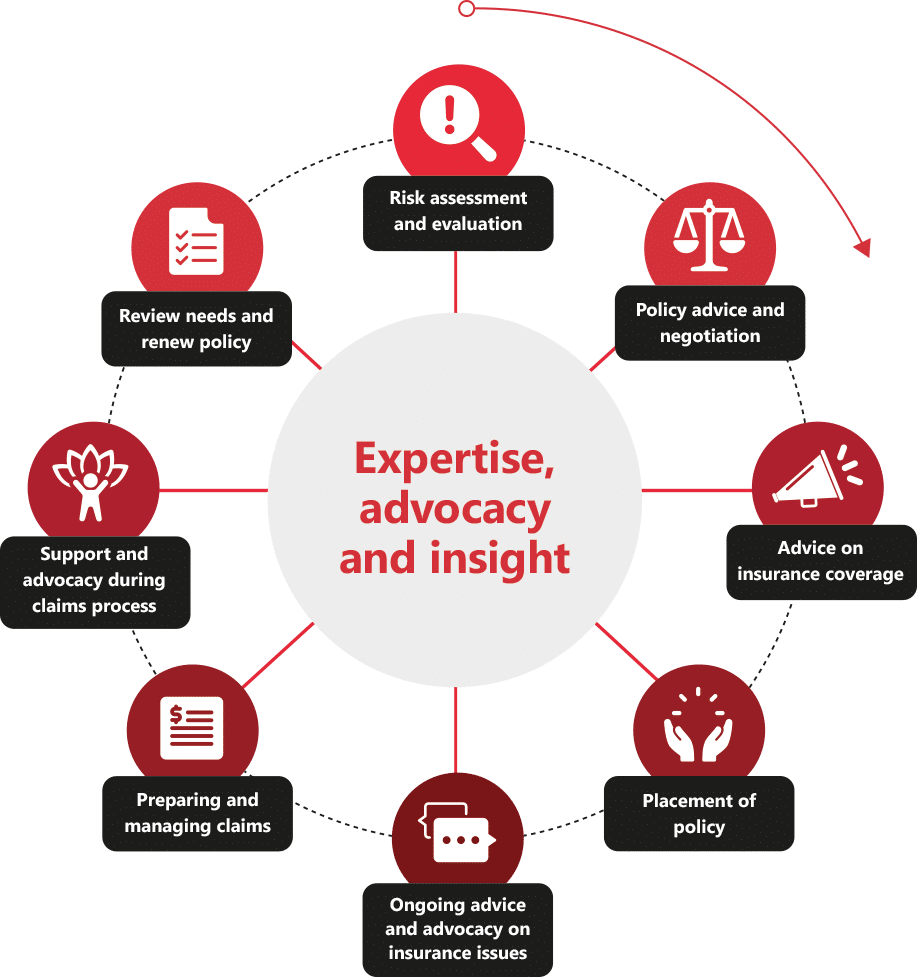

We take a holistic approach to risk management that starts with getting to know you and your business.

- We will look at the risks inherent in your industry (we have brokers who specialise in certain industries and lines of insurance) and those unique to your individual business.

- Based on our risk assessment and evaluation, we will discuss your risk management strategies, including your risk transfer options (insurance), and can review your commercial contracts with a view of aligning insurance clauses and requirements with your insurance cover.

- We will develop your risk profile so that we can go to market to negotiate the most appropriate covers to suit your needs.

When you work with EBM, you are tapping into the strength of our networks and the global associations we are partners with.

Our contacts and affiliations (including being a Lloyd’s Coverholder) also mean that we may offer bespoke policies for your business (we negotiate special wordings and pricing) and offer innovative products. We can find capacity for risks that are difficult to insure.

Our goal is to always negotiate the most appropriate outcome for you.

Our role doesn’t end with securing your insurance program.

Your EBM Account Manager will provide ongoing risk mitigation and insurance advice. Importantly, your broker will assist with the preparation of a claim, and advocate for you with the insurer. We will provide the support you need to settle your claim.

EBM Insurance & Risk also has a dedicated Injury Management Service to assist with Workers’ Compensation claims and offers clients the services of our Risk Solutions Network (RSN) to provide extra support, including assistance in the event of a critical workplace incident.

EBM’s Account Managers work for you and have your best interests in mind.